share

Ready for Your Retirement?

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

informed decisions blog

How To Invest Your Pension at 50 (Make €1m extra in 10 years!?)

October 20, 2025

Can I change my pension investment after 50?

Yes. Most Irish pensions let you switch funds or rebalance anytime. Just watch for exit fees or limited fund options.

How To Invest Your Pension at 50 in Ireland

Turning 50 is a milestone, not just for birthdays, but for your pension too!

It’s the perfect time to pause, consider reviewing your pension investment strategy, and make sure your money is aligned with where you want to go.

For many, 'The Big 5-0' is the start of a new phase of life, and one where they really start to think about their post-work life. They may begin to think more about their financial and non-financial readiness.

This piece aims to show you how to invest your pension at 50 in Ireland, using evidence-based strategies that make sense for one's goals, not someone else’s sales pitch or marketing materials!

I hope you’ll learn something in the following aspects:

• What changes to consider when you hit 50

• How to balance risk and reward as retirement (The Next Chapter!) nears

• How Irish tax rules affect your decisions

• When to seek independent advice

Why Your Pension Strategy Matters at 50

At 50, you’ve likely built up solid pension savings, or are on the path to doing so. The next step is protecting that progress while still aiming for growth into the future. Depending on how close to 50 you will want to convert your pension to an income generating strategy, time may be of the essence here.

Some clients we work with start drawing income before 50, others don't need or want to draw until 70 or beyond, depending on their asset and income mix. There is no one-size fits-all. Suffice it to say, if you are 50 and you intend drawing income from your pension within the next 10 years, time is key.

Many people's goals start to shift at 50.

The big question is: 'Should my investments change too??'

- You may have 10–15 years until retirement. That’s still a long time for compounding to work.

- But you also can’t afford big market shocks just before drawing benefits or buying an Annuity.

- The right pension investment at 50 blends growth with protection in event of temporary storm.

A clear investment strategy, that everyone is on-board with reduces worry, avoids panic selling, and helps you retire on your own terms with confidence - or at least it should!

How To Invest Your Pension at 50 in Ireland

There’s no magic fund or secret trick, just practical steps.

1. Review where you are

- Check your pension’s current value, fund mix, and annual charges.

- Identify how much is in equities, bonds, or cash.

2. Rebalance if needed

- Too much or too little volatility/risk? Gradually shift part into defensive or growth assets.

3. Diversify wisely

- Mix Irish and global equity, funds and assets.

- Avoid concentration in single markets, assets or single-company shares.

- Look for low-cost, evidence-based funds, not flashy, under-performing, high-fee ones.

Example– Conventional Balanced Portfolio at 50 years of age

If you've been following our work for any period of time you'll know our views on the limitations of Lifestyle Investing.

Despite that : ) this is the default on the vast majority of large Defined Contribution schemes in Ireland.

The conventional Lifestyle pension portfolio for someone in their 50's has them invested broadly in the following approach;

Global Equities 45-50%

Bonds 30-35%

Alternatives (REITs, etc.) c10%

Cash c10%

This mix is often recommended by insurance company providers for those in their early 50's, aiming for retirement in c.10 years.

Your plan may differ depending on how soon you’ll draw benefits and your total assets, but this is how they'll have you invested.

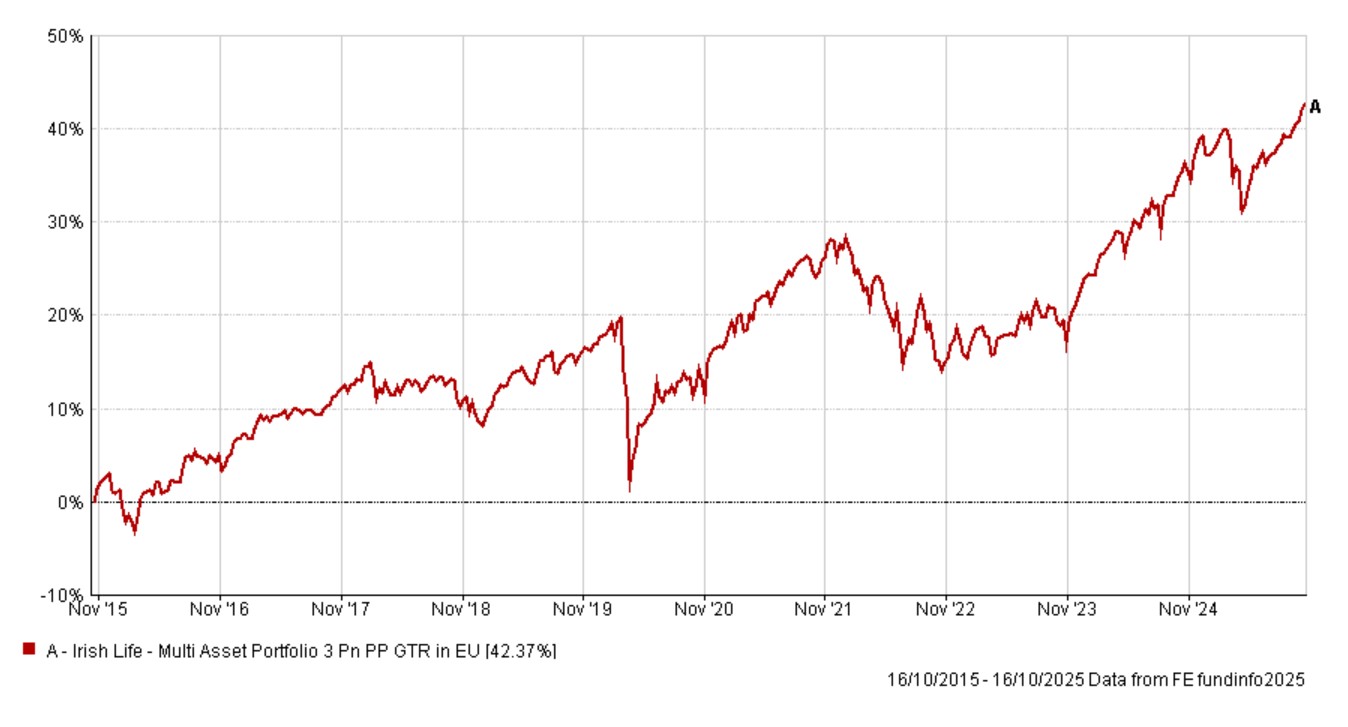

While it may be branded differently in a large DC scheme, the Irish Life (who are one of the biggest holders of assets within large group schemes) 'Multi Asset Portfolio 3' fund is a reasonable proxy for this type of moderately conservative balanced fund.

If you look at the past 10 year performance (it was started in 2015) of this 'MAPS 3' fund, you'll see the following journey:

You'll see the decline of c20% during Covid (vs c30% for high volatility funds), and the correction during 'Liberation Day' in 2025, etc.

MAPS 3, like any middle-of-the-road portfolio, does not protect you from temporary declines.

42% over 10 years equates to an annualised compound return of 3.59%.

According to CSO, Inflation has raised the price of a 'basket of goods' by 25% in that same period.

So, while it has seen it's fair share of ups and downs, this 'balanced' approach, as a proxy for Lifestyle funds for someone in their 50's, has kept up with inflation.

Example – Growth Portfolio at 50 years of age

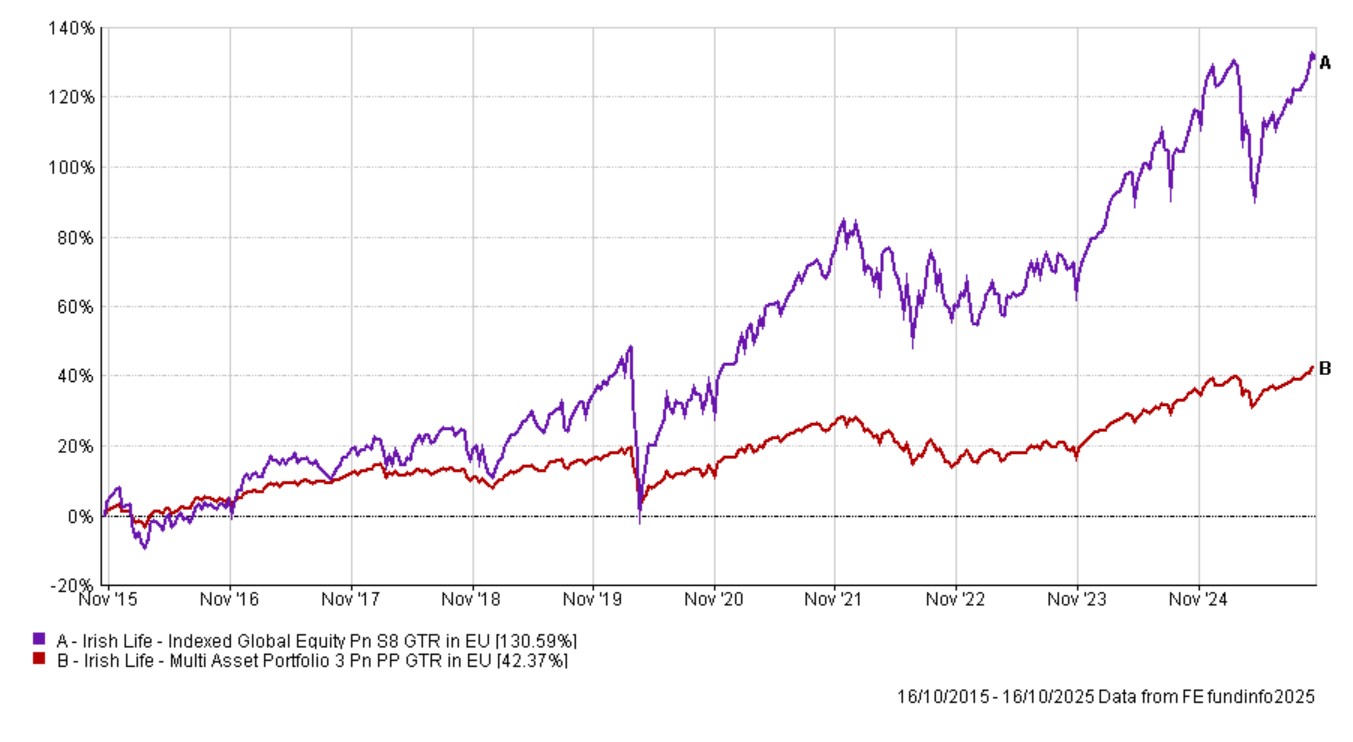

Had you said 'No Thanks' to Lifestyling within your scheme, and you were instead invested in say the Irish Life Indexed Global Pension Fund (not a recommendation, merely an available scheme proxy for investing 100% in equity!).....how would you have got on?

You would have achieved c130% growth versus the MAPs 3 c42% growth.

The IL Global Equity Fund was and is more volatile of course (c36% decline during Covid vs c20% of MAPS 3 for example).

Investing Your Pension in Global Equity funds provided by Vanguard, iShares or Dimensional?

If you were in a position to invest in funds directly with Vanguard, iShares Blackrock or Dimensional, how would you have got on in the past 10 years? The data may or may not surprise you...

iShares (Blackrock), and Vanguard each delivered c193%

Dimensional Global Core 165%

Irish Life Indexed Global Equity 130%

Each of these were invested 100% in Global Equity - they are absolutely like for like.

The results speak for themselves, so I won't add anything further, I swear!

Investing €1m Pension in The Various Options Analysed Here

Had you invested your €1m pension pot in 2015 into the various options we have analysed so far here, what would you have today in your pension, assuming you'd been taking 5% of this illustrative ARF pot value as income each year (starting with €50,000 Gross in 2015)?

The variance of outcome has been huge!

Had you invested your illustrative €1m ARF in the iShares Developed World Index fund in 2015, drawn 5% every year as income, you would have €1m more today than had you invested in a middle-of-the-road fund like the Irish Life MAPS 3 fund. (Accredited to a bewildered Independent Financial Planner from East Meath!)...

Should I move to a lower-risk fund now?

Gradual adjustment can make sense for some people who fear volatility and/or who will hand the entire pot over to buy an annuity at a certain point in time. However, evidence suggests it is not a smart move for long term ARF holders generating inflation-adjusted income and trying to leave a large legacy. Inflation still eats into returns.

Tax and Access Rules at 50

You generally can’t access your pension before age 50 unless you’re in a specific occupation (like certain sports professionals) or retiring early under a company scheme.

At retirement, or more accurately, at the point you want to draw-down your benefits, you have choices.

You can opt to take up to 25% of the fund value as a lump sum, the first €200,000 tax free, and the remainder of the 25% at 20% tax - if you get me! The rest can move into an Approved Retirement Fund (ARF) or an annuity.

Choosing between them affects flexibility and tax exposure:

Option Flexibility Tax on Withdrawals Risk

ARF High Income taxed as ordinary income Market/Portfolio risk

Annuity Low Fixed income, taxed No market risk, no growth, no legacy, c50% income on death

You may have multiple pots which you may take different approach on over time. You might invest them differently, access them at different, phased times into the future, and/or use an ARF for some and Annuity for others. The choices are potentially endless, and require careful analysis - not something I'll cover here today.

When To Seek Advice

If you’re asking yourself, 'Should I change my pension investments at 50', you’ve already hit the point where advice would likely pay off. My recommendation is to do the following;

a) Speak to your existing providers/advisors to see what assistance or analysis they can do. If they are rubbish to can't or won't help, move to b)

b) Search for a verified and well regarded financial planning firm/advisor to do an assessment and outline the pros and cons of the choices available to you

c) Take your time before making any changes - let it sit with you before deciding on a severe change of course.

An independent financial planner should help you:

- Align your pension strategy with retirement goals

- Avoid emotional or tax mistakes

- Create a sustainable withdrawal plan

Evidence-based investing removes hype and focuses on long-term data.

At Informed Decisions, that’s exactly how we work; clear, no-nonsense guidance tailored for Irish investors. But I'm not here to plug our services!

Conclusion – How To Invest Your Pension at 50 in Ireland

At 50, your pension deserves more than autopilot. Review your long-term strategy through the lens of your long term intentions.

If needed, rebalance smartly, and stay invested in evidence, not emotion.

The best time to take control is now. Start planning, and future you will thank present you!

I hope this helps.

Paddy Delaney QFA RPA APA

Disclaimer

The content of this site including blogs and podcasts is for information purposes only. Everybody’s financial situation is different and the content we share on our site and through podcasts may not be applicable to you.

The articles, blogs and podcasts are not investment advice. They do not take account of your individual circumstances, including your knowledge and experience and attitude to risk. Informed Decisions can’t be held responsible for the consequences if you pursue a course of action based on the information we share

How much should I have in my pension at 50?

A common target is 6–8 times your annual income by 50, but it varies based on lifestyle goals and retirement age.

You may also like...

Retired or close to it?

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

.svg)