Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

November 3, 2025

Neither is “better” — ARFs offer flexibility and inheritance, annuities offer guaranteed income. The best choice depends on your needs and attitude to risk.

Reaching retirement with a €1m pension pot is a major achievement and milestone. However, it also comes with one of the biggest financial decisions you’ll ever make: whether to take your income through an ARF (Approved Retirement Fund) or to instead buy an annuity. It's a big question, with potentially big impacts on your financial future and well-being. This piece will hopefully give you some useful information, but a Blog-post alone may not be sufficient to help you answer it!

Both routes have pros and cons under Irish pension rules, and the right choice depends on your goals, risk tolerance, and lifestyle priorities. In this piece, we’ll break it down in plain English (hopefully!), with practical examples that show how a €1 million pension can work for you in today's realities.

What you’ll learn:

An Approved Retirement Fund (ARF) is a post-retirement pension account. You move your pension from the existing scheme(s) and 'crystalise' them into a new ARD which you set up. The pension assets remain invested as you and your advisor decide, and you draw income as needed. You choose (or your advisor helps choose) how it’s invested, be that in insurance company funds, UCITS ETFs, or managed portfolios. And you can control withdrawals to suit your needs, provided it is in line with Pensions Authority rules!

Under these rules, once you move your pension to an ARF, and you are 60 or older, you must take a minimum annual withdrawal (currently 4% from age 61, 5% from 71, and 6% if your ARF exceeds €2m in value in any year). Withdrawals are taxed under PAYE, so depending on the income you have from the ARF plus any other sources, you may or may not pay much Income Tax on the income. Interestingly, you are taxed on this 'imputed distribution' requirement, even if you don't withdraw the funds in any given year!

The key benefits: flexibility, growth potential of the ARF fund, and inheritance value, legacy.

The downside: exposure to investment risk and potential to deplete or spend the fund too quickly.

There are lots of companies claiming to have the best ARF funds - read this piece to ensure you know what good looks like!

An annuity is a guaranteed income for life, purchased from a life company using your pension pot(s).

The provider takes on the investment and longevity risk, allowing you simply receive a fixed or inflation-linked payment every month for as long as you live.

The trade-off: once you buy an annuity, all your pension savings/capital is gone. You gain certainty but lose control and potential growth and legacy upside of an ARF.

Typical Irish annuity rates in 2025 hover around 4.5%–5.2% for a 60-year-old single-life policy depending on escalation and rider benefits. This means a €1m pension converted to an annuity might buy €45,000–€52,000 per year of income until you die (before tax).

Let’s compare how a €1m pension could play out under both options.

If markets perform steadily, the ARF could sustain this income for 30+ years, plus leave a meaningful legacy.

But if returns disappoint early on, the pot could erode faster.

The variances of income you will get from annuity can be large, depending on rates available, your age, and the benefits you want (indexation, survivor income etc.):

If you wanted to add some nice benefits to that annuity; guaranteed income for minimum 5 years, indexation at 2% per year, and 50% spouse income if you die before them:

ARF Pros:

ARF Cons:

Annuity Pros:

Annuity Cons:

Yes. You can split your pension — for example, annuitise part for stability and keep part in an ARF for growth and flexibility

With an ARF, any remaining balance at the time of your death passes to your spouse or estate.

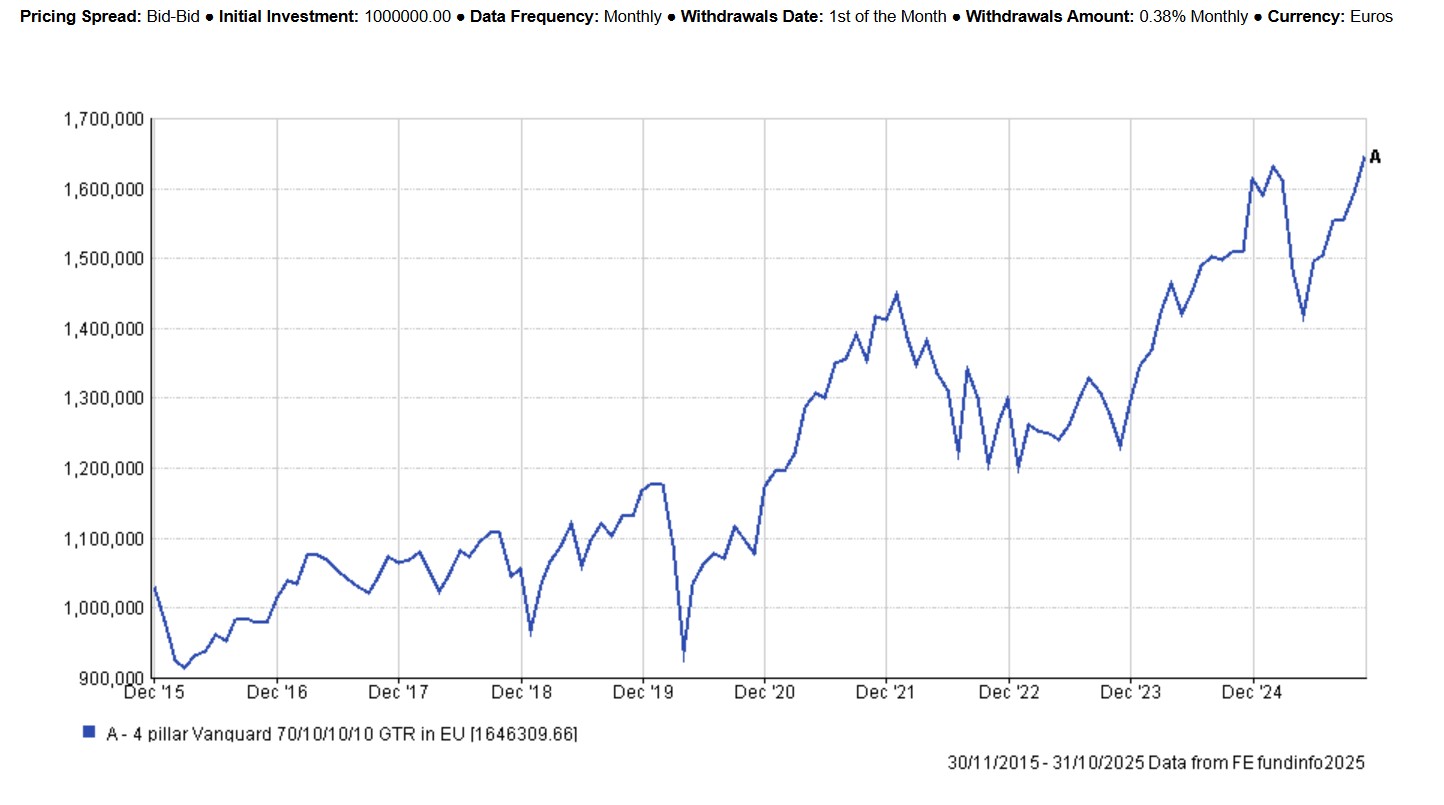

Imagine you took out an ARF in 2015, investing €1m at the time when you were 60. We've modelled that you invested in 90% Equity and 10% Bond here, a growth-oriented and high volatility portfolio (based on prudent research here!). Initially you may have questioned your decision to take the ARF, as 3 times in the first 4 years your ARF value fell below the initial invested amount. However, you held firm!

You're 70 now, and you have died, I'm sorry to say!

Interestingly (but of no real value to you other than a nice legacy!), your ARF is now worth c€1.6m, even after the 4.5% annual income withdrawal - which had grown over the years also.

Your spouse who is obviously desolate without you, will 'step into your shoes' and become the proud owner of a c€1.6m ARF from you, and receive the annual income from here onwards.

If he or she are aged 70 or over, they'll be obliged to take 5% per year from now - so that'd be c€80,000 Gross this year based on a 1.6m ARF valuation.

When (not if!) he or she dies, the full value of the ARF will pas into their estate.

If your kids are 21 or older, they will be charged a flat 30% income tax rate on the cash they each receive from the ARF, irrespective of what they may have or will inherit. The cash they get from such an ARF in that scenario is outside the inheritance Capital Acquisitions Tax (CAT) regime. If they are under 21, it falls into the CAT calculations along with any other assets they inherit.

With an annuity, payments stop at death unless you’ve added a spouse’s pension or guarantee period (which reduce the annual income rate but offer some future payment potential). If you have added spouse's/survivor's benefit, and they die before you do, then there is no future payment unfortunately once you die.

The insurance companies hire teams of actuaries to ensure the rates they offer on a rolling basis for new annuity contracts are tilted in their favour, otherwise they'd potentially be unprofitable, collapse and not be able to pay their annuity liabilities! Having said that, most don't want to see them making too much margin either!

Absolutely. Some retirees choose a blended strategy using part of their pension assets to buy an annuity for essential spending (e.g., €300k for guaranteed income of say €12k per year) and keeping the remaining €700k (generating say 4.5% or c€32k gross) in an ARF for flexibility, growth and legacy potential.

This mix can provide both peace of mind and long-term potential, and helps smooth out inflation and longevity risks. Potentially!

For many, the thoughts of handing-over any of their pension for annuity is preposterous, but it's a fair strategy in many cases!

Once you are in receipt of either ARF or Annuity income, they are both taxed as any other income.

Either way, your ARF or annuity provider does the calculations for you, deducts tax due, and pays you the net monthly (or however often you requested) income net of taxes, along with a payslip.

The beauty of the ARF (and possibly annuity) is that one can crystalise different pension pots at different times to an ARF, and draw tax-efficient (lower) income over time, to suit their income need and their tax planning. That's one of the big advantages, particularly when under 60 when there is no minimum distribution percentage. One can take as much or as little as suits their needs each year in that scenario!

The 'right' answer isn’t about chasing returns or guarantees, it’s about matching your income sources to your preferences, attitude, income need and goals.

Either way, a €1m pension pot ARF or annuity decision deserves careful, personalised modelling, ideally backed by cashflow forecasts and tax analysis.

Before locking in your choice, take time to model both routes under real Irish tax rules and market assumptions.

Book a Retirement Clarity Call with Informed Decisions to see how your pension can deliver lifelong, inflation-adjusted income that fits your lifestyle and priorities.

A €1 million pension gives you genuine freedom, but freedom comes with decisions!

Choosing between an ARF and an annuity in Ireland is less about rates and more about what lets you live comfortably and confidently.

Take advice, run the numbers, and pick the route that lets you sleep at night, knowing you've done all the due diligence you can.

I hope this helps.

Paddy.

Oh - almost a year ago, 9th December 2024, I wrote about investing at all-time highs in equities. At the time, the S&P 500 was at 6,090 (now 6,840, +c19% and the Eurostoxx was at 4,980, now 5,700, +c17%). I guess that answers that!

The content of this site including blogs and podcasts is for information purposes only. Everybody’s financial situation is different and the content we share on our site and through podcasts may not be applicable to you.

The articles, blogs and podcasts are not investment advice. They do not take account of your individual circumstances, including your knowledge and experience and attitude to risk. Informed Decisions can’t be held responsible for the consequences if you pursue a course of action based on the information we share

Your ARF balance passes to your spouse or estate, potentially taxable depending on who inherits.

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.