Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

22nd July 2019

If you have, or are soon to have, an Approved Retirement Fund (ARF) you might benefit from the following research. Wondering how to make your ARF last longer? How to generate as much income as feasible from your ARF? This week we continue where we left off 2 weeks ago, and as promised share some strategies that can

Welcome to Ireland’s #1 Finance Blog, where we’re on a mission to share insights that’ll hopefully help you with money. If you have any questions, feedback or suggestions on the back of this piece please do get in touch with me directly here. Would love to hear from you.

Whats The Problem?

Some might say that I’m being over-dramatic, and that there is ‘no need to worry’ but Blog 117 & Podcast 143 proved that there is need to pay attention to how we manage our ARF incomes. In this piece of research we showed that taking an inflation-adjusted income of 4% per year from age 65, and then increasing that income to 5% from 71 to 90 stands a historically awful 30% probability of actually lasting. If we are speaking in ‘battery’ metaphors that’s akin to the cheap and nasty batteries you buy in the pound-shop which you know won’t last long but hey they’re cheap!

The median outcome is that the pot is gone by early 80’s. This was based on a 40/60 Equity/Bond portfolio, and a 1.2% total fee.

So the real problem here is that we have entered an era where the vast majority of us retiring (outside of the Public Sector) in current interest rate environments will be doing so with an ARF. We will not be retiring with 100% of our income derived from Defined Benefit schemes. That by itself is bad enough. What compounds the problem for us is that it is now deemed ‘common-sense’ to invest in the above way, most likely pay much higher fees, and to ultimately walk into a later-life with little or no retirement income sources.

What I will do now is to share some basic strategies that have helped others to improve their chances of successful outcomes when it comes to sustaining themselves into the future and living a life of financial independence.

The Impact Of The Asset Mix?

It is one we have covered before but let’s examine it’s impact on this very scenario. How should I invest my pension in retirement? Culturally we’re told to invest in ‘conservative’ funds which hold large swathes of Bonds. Indeed most pensions will automatically switch you into these funds as you get older. We’ve written about them too in Blog 53. I get the idea of trying to reduce volatility but to what end? If I am retiring at 65 I still aim to have another 25-30 years of living to do, what’s the logic in investing it all for 25 or 30 years in an asset class that had delivered sub-optimal long term returns??

If you were to have listened even a little to the truth tellers who hail Equities as the most logical and rewarding long term asset class you would have fared far better than the 30% probability we discovered in our earlier scenario. Imagine you were to have reversed the split on your portfolio from 40/60 Equity/Bonds to 60/40 Equity/Bonds from age 65 in the above scenario. What impact would that have on your chances of success? While it might not sound like much you have gone from a pitiful 30% chance to an almost 50/50 chance with 47%. While 47% is not quite probable enough for most of us that simple switch delivered a 63% improvement of successful outcomes on the original strategy.

Hold Only 2 or 3 Years Worth Of Income In Bonds?

I’ve long put forward the idea that even keeping 40% of your portfolio in Bonds in ANY long term structure, whether that is Investment or Pension is absolutely crackerjack, you are most likely costing yourself money – yet many still do it. If you had decided therefore at 65 to hold only 10% of your portfolio in Bonds and the remaining 90% in Equity. Given that you are taking 4% and then 5% of your pot each year this 10% represents essentially 2 or 3 years of annual income. In this portfolio we have taken a diversified approach to the Equity holding, with some different equity strategies using Index funds, combined with a simple Global Bond Index.

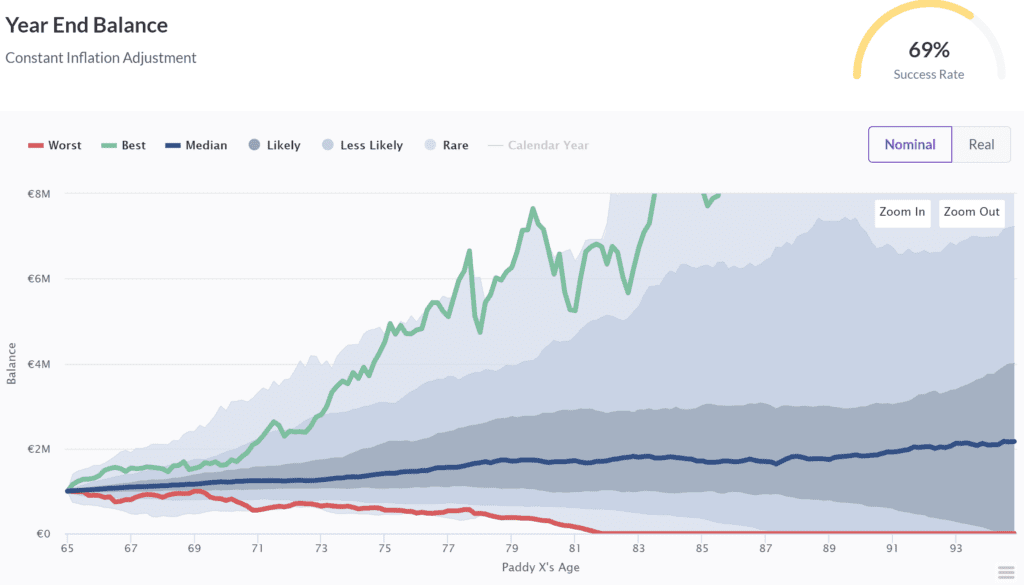

By making this tweak to a portfolio at 65, over every period of historical data, our chances of success have gone from 47 to 69%. While not quite Duracell Bunny territory your ARF is performing better for a much longer period now!

Withdrawal Strategy?

So in these scenarios we have been assuming we are taking an increase each year in line with inflation, so as to maintain our standard of living. I want to now share with you the impact of maintaining some flexibility with regards your annual inflation-linked increases. Needless to say if you don’t take the increase each year your plan will stand a greater chance of lasting at least as long as you do. There are several strategies which guide how we go about this approach, each will have a different impact depending on the variables at hand. One of the main ones I want to share here is what is sometimes referred to as the Guyton-Inflation-Adjustment for withdrawals from a pension pot. Quite the mouthful.

As complicated as it may sound it is very simple a strategy. Jonathan Guyton, the US financial planner who put forward this approach in the early noughties, suggests only taking an increase in line with inflation if your portfolio has had positive returns in the past year. If portfolio returns have been negative then take the same this year as you did last year, irrespective of the rate of inflation.

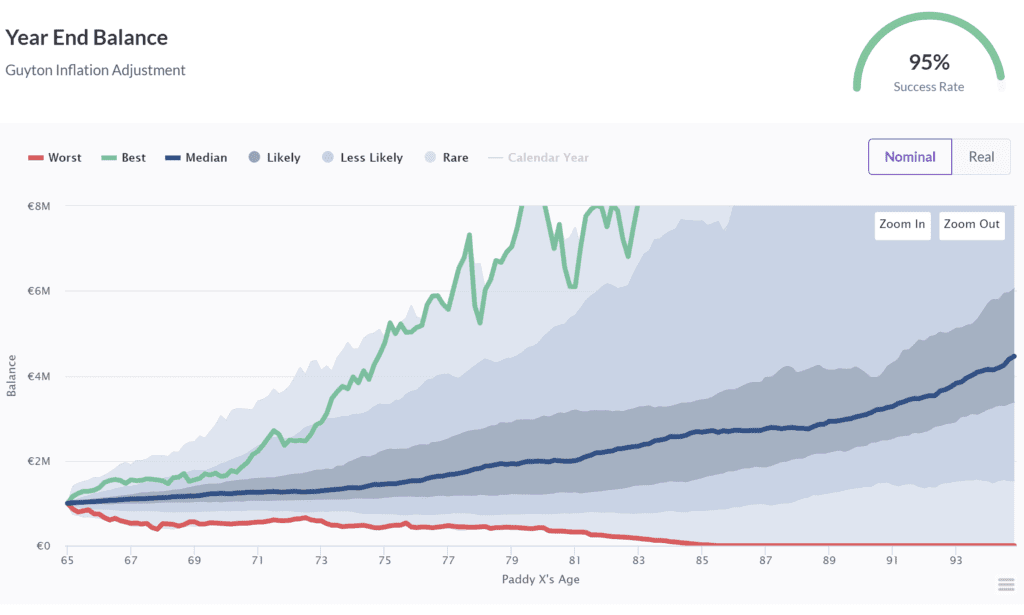

So I took our 90/10 Equity/Bond approach which had a 69% success rate. Instead of taking an increase every year we only took an increase following a positive portfolio year. A simple approach, which resulted in a Duracell-Bunny-Esque success rate of 95%!! Indeed with some further tweaks to the portfolio we got as far as 99% using this withdrawal approach.

Not only did your success rate increase to 95%, you will observe from the final graph here in Blog 118 that your Median final pot nominal value at 95 stands at well over €4m!! Which then begs another question!

Should I Take More Than 4% From My ARF?

Well in reality the more you take the higher your probability of running out well before you do, no matter how likely a given strategy is to work. In the scenario just outlines the worst case was that you ran out at 85, this was the worst of all historical years. Had you happened to have begun your strategy in that year you would have run out before 85. Simple Maths (well not that simple but you hopefully get my meaning!). It’s one that has been asked of me on several occasions of late, and is one I intend to answer here in general terms in the near future. What is also on the list is the different types of Spending Strategies there are and how they can be applied in income draw-down strategies to useful effect.

Conclusion:

We do not know how Equities and Bonds will perform over the next 118 years, which is the data that these success rates are based on. What we do know however is that if you wanted your Bunny to keep going there were some simple approaches one could take to help them avoid costly and irreparable loss. Reaching a 95% success rate is, in anyone’s book, a very significant probability, and one which most of us would be willing to pursue. I guess the question comes down to whether you are comfortable to ignore the snake-oil merchants who will continue to tell you to do what they have always been told to tell you to do!?

Paddy.

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.