Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

18th November 2019

Looking for Financial Advice in Ireland you can trust? A few weeks ago I did a piece on finding ‘Independent Advice in Ireland‘, this week I intend to share some ideas that might help you evaluate a firm before engaging them.

“I just checked my investment portfolio – now I know why they call them Brokers” – anonymous. I came across that quote in a sketch cartoon recently and found it amusing. With MSCI Index up over 20% so far this year it’s not really applicable however!

They are known as many names, such as Broker, Financial Advisor or Financial Planner. Perhaps you already have an advisor but are unclear about their intent, fees or abilities. You may have had several over the years but none really ‘did it’ for you! Or perhaps you are thinking about engaging one for the first time. I hope this piece will help a little.

I fully accept also that being a fully independent fee-based advisor, I will carry some biases here – but as always I’ll tell it as I see it. Trust is a funny thing, with many of us suggesting that it has to be earned, but you have sometimes have no option but to extend the trust and then hope that your gut was correct! I love Stephen Covey’s concept of trust only existing at the intersection of ‘Competence’ and ‘Character’. He infers that if we feel either of these is missing in someone we will unlikely trust them.

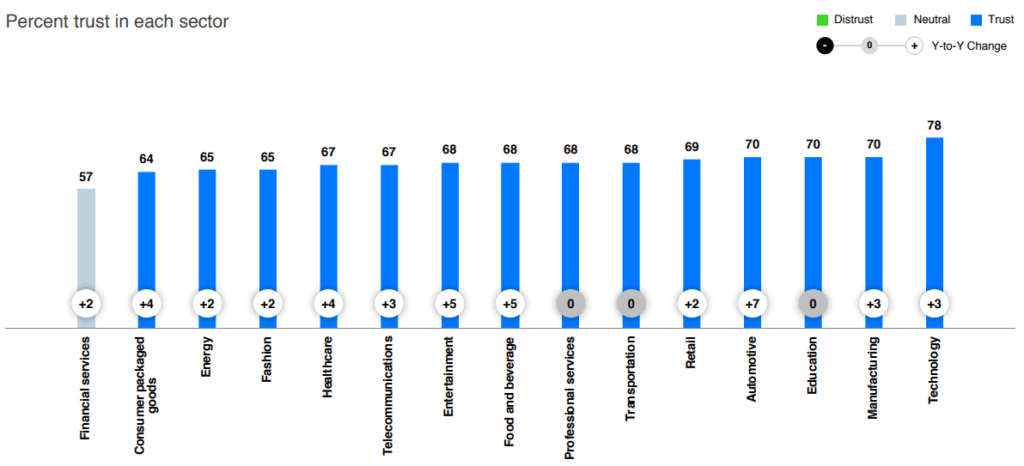

I’ve mentioned it before, Edelman Trust Barometer. It is a global research study carried-out by this huge communications company, Edelman. Their 2019 study has shown that Financial Services, globally, is the least trusted sector of them all. We have climbed 8% in the past 4 years but still bottom of the pile. Given my deep fondness and belief in the value of Financial Advice for people, this is a real shame. The pic below shows how we rank, and you can read the full, and really interesting report here.

I am conducting my own small bit of reasearch, specific to Financial Advice in Ireland. I am keen to have individuals and business owners complete this 2 minute survey here. Ideally you will not work in Financial Services yourself. Please pop your email in at the end and I will share the research finding with you early in the new year. Complete survey here.

So here are my 5 tips, in no particular order, to help you find an advisor worthy of your trust.

Last week the Central Bank of Ireland (CBI) hosted the third edition of their annual ‘roadshow’. This is a half-day session hosted by the managers of various departments of CBI who are responsible for governing how financial advice is done by the country’s advisors, brokers and financial planners. It was my first time being able to attend, and it was pretty enlightening. The scope and level of governance they place on authorised firms (advice providers who have been screened and given the go-ahead by CBI) is pretty significant. Having said that, by their own admission, once a firm is authorised, they cannot constantly check on them and review what that advisor is doing at all times. And this is where there is a potential issue for someone seeking advice.

Any regulated advice firm in Ireland must hold Professional Indemnity Insurance to protect their clients in the event of some form of mal-practice on the firms’ behalf. While every advice firm is obliged to do an annual ‘return’ to CBI each year to confirm that they have this insurance in place, there is nothing to force them to actually have it in place! If they were subject to a random spot-check or audit then it could come to light. It seems that a % of firms even today do not have PPI in place. If you as a client were ever unfortunate enough to have reason to call on that insurance you’d really hope that it was in place and sufficient. If it helps you could request a copy of a firm’s current PPI cover before engaging them.

At that same meeting a CBI representative suggested they really don’t like authorised or regulated firms under CBI governance, who provide financial advice in Ireland to be selling what are known as ‘unregulated’ products. A typical unregulated product offered by many brokers are investment opportunities in wind-farms, shopping centres etc etc. CBI suggested they really don’t like the fact that a consumer can get advice from a regulated entity but end up investing in an unregualted product – meaning the client is not protected by CBI regulation.

When they find a firm acting outside the rules they take action against that firm. On their website they list all enforcement actions that they take against such advice and regulated firms. If you would like to see some examples of firms not adhering to the rules and regulations you can find them on the Central Bank website.

2. Agency & Commission Arrangements

Financial advice in Ireland has always been dominated by commission-based advisors. It is what we are used to, and what I worked in for many years. There are a tiny but growing number of truly independent advisors who get paid a fee instead of commissions. Based on my own experience in working with advisors, and on feedback from clients I work with directly, how an advisor is paid is a factor for many clients when shopping around.

What is known in the advice profession as ‘Conflict of Interest’ is a big area. The vast majority of advice firms in Ireland operate under a commission basis, where they are paid various levels of commission from various product providers and insurance companies for selling their product. In principal there is nothing wrong with this, but Central Bank have concerns that this leads to a conflict of interest. As a result all firms must address this in their Conflict of Interest Policy. In addition the CBI are bringing out new proposed rules next year which will mean all firms must fully disclose the level of commission they get from each firm that they sell products for, even before a client engages them. This will make it easier for people to see what the advisor will be getting if they buy x,y or z.

Conflict of interest is a funny one though, I firmly believe that no advisor nor indeed no professional provider of any service or product is free of some form of conflict of interest. Is it in your dentists’ interests to tell you to get that extra filling, even if it is possibly marginally needed?? Is it in your car-dealers interest that you upgrade from a C-Class to an E-Class?? Is it in your plastic surgeon’s interest to tell you to get your chin reduced while they’re also doing your tummy!!? We get advice, guidance and services and products from people pretty-much every day which is potentially conflicted. That is not suggesting we ought all become highly cynical of everything everyone tells us from this day forth, but I do encourage people to be aware of potential conflicts. Given that the levels of trust in Financial Services is already quite low across the board this cynicism seems to be alive and well already!

There is an argument that a fee-based advisor who does not earn commissions from any providers may have less conflicts of interests. As one of these I suggest that this is indeed the case. There are still conflicts as with any professional service however the depth of those conflicts appear much less than the alternative.

3. Expertise

This is the ‘Competence’ of the above ‘character & competence’ concept mentioned earlier. You wouldn’t engage a doctor that didn’t know what they were doing – just as you wouldn’t engage a fianancial advisor that didn’t know what they were doing. In both cases the consequences could be just too awful to take the risk!

And just as within medicine there are specialist areas of financial advice. Does the advisor you are scoping-out have the relevant expertise to help you? Do they have the expertise relevant to you and your stage of life or circumstances. Or are they trying to be all things to all people?? I was training an advice firm recently and in advance of meeting with them I was reviewing their website. It outlined that they ‘specialised’ in working with Executives, Managers, junior managers, Business owners and all private and public sector employees! Needless to say when I queried them on this, the penny dropped! There are so many different facets to ones financial planning, that an advisor could work for 2 or 3 years without coming across different aspects. I do believe that it can pay dividends to work with an advisor that is familiar and has plenty of recent experience and competence in the areas and aspects that are most relevant to you.

4. Connection – Financial Advice in Ireland

This, I suggest, is the establishment of what an advisors’ ‘character’ may be, and if that is a good fit for you. Most of us will trust our gut when we meet someone as to whether we believe we can work well with them. There are a few aspects you can look out for to help evaluate them when you are face-to-face.

a) Do they go straight to the money!? If their focus at any stage in the first meeting is about money it might, but not necessarily will be a flag. Questions about how much you have, or how much you want to invest, or how much you can afford to put into pensions etc. will usually point towards the primary interest being your money, and not you. I get it that some people like to get straight to the chase, but I caution that approach if you observe it in advisors. If financial planning is what you are seeking, and an advisor goes straight to the money it might be time to consider their intent.

b) Answering your questions? I was recently contacted by a potential client whom had read an article in the paper written by Carl Widger of Metis Ireland in Limerick. In it he shared 6 questions that you should ask of a financial advisor. They asked me the questions, and I was delighted to be asked them. I know Karl and it was kinda amusing to be asked the questions that he’d written about! For me, it was a great opportunity to talk about how I work independently, how I deliver results, and how I aim to bring significant value to the clients. I’d do it anyway but it also helped us get totally transparent and upfront about how I am paid for what I do.

I’ll do a ‘5 questions to ask your financial advisor’ piece in the near future, Informed Decisions style! In the meantime, don’t be afraid, indeed you really must ask the difficult or potentially awkward questions before engaging with an advisor – you don’t want any nasty surprises when the relationship has already begun!? If not comfortable asking them face to face then maybe email them and ask for email responses.

When it comes to finding financial advice in Ireland I suggest you trust your gut – we’re all adults. It’s OK to say ‘NO’!

5. Value

What will the advisor actually do for you? Do they have any form of documented service offering on an on-going basis? If the offer is to just sell you a product and then send you a statement each year then that may not be great value. This is particularly so given you’ll likely be paying for the privilege every year via commissions to the advisor.

I would always encourage people, particularly when they come to me for help, to figure-out what they actually want from an advisor! if it turns out they don’t actually want an advisor then I’ll tell them that and wish them the very best. So if you are engaging an advisor, what do you want from them? It is then a case of figuring out if they can deliver on that. I’ve said it before and I’ll say it again, there are literally hundred of thousands of people who are paying in the region of 1%-1.5% per year in fees for their investments or pension, just to the provider. In addition they are paying another 0.5-1% per year in fees which is going to the firm/advisor that sold them the investments or pensions! If you are not getting any form of service, planning or genuine support in return for that fee it’s only just that you find someone who will.

This is coming to a head in the UK (expect it to land here in about 15 years!), with the Regulator (FCA) now cracking-down on unjustified fee-incomes. The FCA are putting an onus of proof on these firms to show how they are delivering value to the consumers in return for their annual fees.

Conclusion – Finding Financial Advice in Ireland

The vast majority of the hundreds of financial advisors I have had the pleasure of working with over the years are genuine and worthy of your trust. Heck, a lot of them I’d refer my mammy to! Given the impact that the relationship can have for you over time, I do think it is worth investing some time, thought and effort in ensuring you pick one that will help you avoid mistakes and achieve the results and life goals that you seek.

If you haven’t already please do complete the short ‘Financial Advice in Ireland’ survey below, thanks so much…..

Paddy Delaney QFA RPA APA

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.