Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

9th March 2020

DAvy GPS Funds – An Independent & Unbiased Analysis.

This week, following a recent conversation (there I go with ‘conversations’ again!), we share a detailed analysis of the Davy GPS Funds. You may be thinking of investing, or are already invested, via pensions or investments. Either way, we share insights on what are they, what’s in them, how they compare to their competitors, and how they have benefited investors that have entrusted their funds in them.

Welcome back to Ireland’s only dedicated and award-winning Personal Finance Blog & Podcast. Now that I say it, it’s great to see other money-related Bloggers and enthusiasts such as Vince in Financial Independence Ireland, and Kel in Mrs. Smart Money. It’s people like these two who are really sharing great insights on money, and are making a difference to people all over the country – surely worth a ‘hat-tip’!

Last week we had a call from a regular listener to the podcast asking if we had any views on the Davy GPS Funds range. They were considering investing via their pension and sought our opinion. We knew of the funds, and their broad performance, but had no deep awareness of how they were invested or performing. So once we had a look for our friend we decided to share the info we discovered, in the hope it might help people looking at their options for investing in the Davy GPS Funds.

We’re keen to reiterate that we have no professional links with Davy or these funds (we prefer our independent and complexity-free approach to clients’ investments). We were certainly not paid to do this analysis, same as were not paid to do our independent analysis of the Multi-Asset Funds. You, dear reader, can therefore rest assured that this is a black & white, fact-based review of the funds as we see them, however that may be…..being independent allows us to analyse funds in an non-conflicted way!

The 3 Davy GPS Funds:

Maybe you are already invested in them – or are considering of investing in them. In any event you’ll likely have considered the 3 different options that they present to investors under the GPS ‘brand’.

The GPS Funds are made up of a large collection of (mostly) ‘Undertakings for the Collective Investment in Transferable Securities’, or UCITS as they are thankfully known! This is a regulatory framework which facilitates the buying and selling of mutual funds across Europe. UCITS funds are indeed regarded as safe and are fully-regulated investments. We’ll share a proper piece on UCITS in the near future. Ultimately, we like UCITS here at Informed Decisions, and they are an increasingly popular alternative to traditional investment products for good reason.

Anyway, GPS stands for Global Portfolio Strategies. You may have a broker that is promoting them to you, or you are going direct via Davy Select or Davy Discretionary service. Either way, you will likely have access to any of the three Davy GPS Funds. Here’s the low-down as per their marketing material:

Davy GPS Funds Composition:

The approach they take to diversifying these funds is similar in many way to how most Multi-Asset funds go about it – using various Asset-Classes in a way to achieve an appropriate balance of volatility and potential returns. See our recent Blog where we analyse some of Ireland’s most prominent Multi-Asset Funds. For us, it was quite an interesting piece of analysis.

According to their product updates, the following details are accurate as of December 2019. Similar to some of the Multi-Asset funds we analysed in Blog 127, the Davy GPS funds consisted of the following (rounded) totals:

Cautious Growth Fund:

It achieves this overall composition by bundling approx 30 different underlying UCITS funds into this ‘portfolio’ and presenting it as this particular product. While it is not unusual, 30 underlying funds can be deemed on one hand, as very well diversified, and on the other hand, a mish-mash of complexity that will unlikely deliver what you need. Two different views of this approach.

You’ll see a dose of Absolute Returns Funds in here – see our recent Blog here which explored how terribly they have been received of recent years.

This fund, as per our analysis has a Volatility Rating of approximately ‘3’, which is almost as little volatility as one could achieve outside of a deposit account. That’s where it is designed to be at obviously.

Balanced Growth Fund:

You will see that, given it is targeted at delivering greater returns than the Cautious Fund, this portfolio is made up of more Equity and less Bonds. Stands to reason. They do insist on holding onto some Absolute Returns Funds though.

This Balanced Growth fund, as per our analysis has a Volatility Rating of approximately ‘6’, double that of the Cautious Fund – bang on what might be described as ‘moderate risk’ fund. Again, we guess this is in line with how they put the portfolio together.

Davy GPS Long Term Growth Fund

The third, and most volatile of the three funds in the range holds the following approximate underlying assets, again generated by a combination of different percentages of broadly the same 30 UCITS funds as is the other 2 funds. The volatility of this third fund is in the region of ‘8’, so it’s approx 35% more volatile than the Balanced Growth Fund.

Davy GPS Funds Performance:

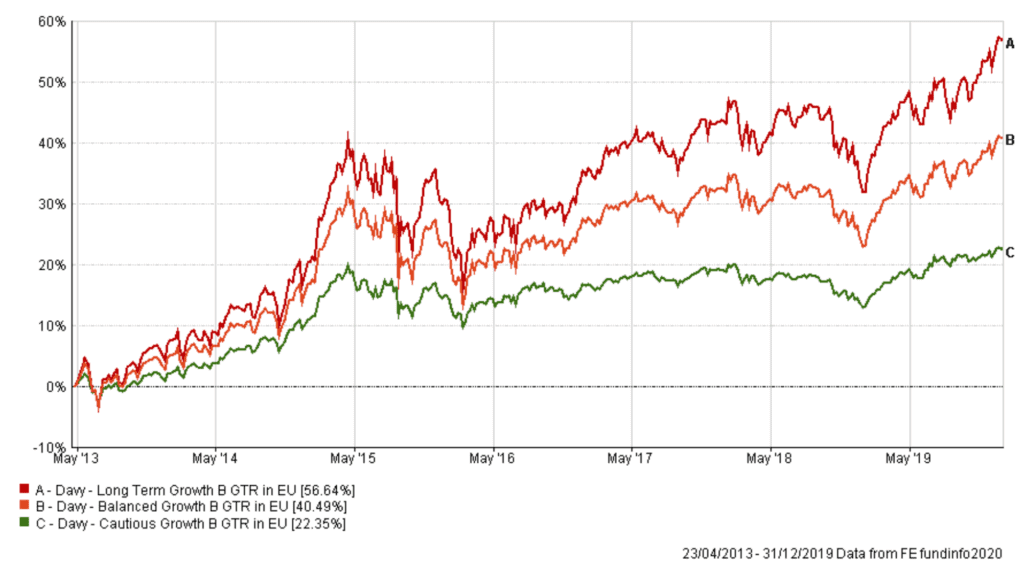

Below you will see the three GPS Funds mapped from their launch date to the 31st December 2019. As you would expect the more volatile fund (Long Term Growth) has delivered returns most true to global equity market returns. The least volatile has been more-so correlated to Bond market returns – given it holds a large proportion of Gov’t and Corporate Bonds.

Since May 2013, the Long Term Growth Fund has delivered 56.64% total returns – which is certainly not to be sniffed at. The Balanced Fund a healthy 40%, and the Cautious Growth Fund 22%.

This all sounds impressive, but how has it stacked up against it’s rivals in the Multi-Asset Funds world (if there is such a world!).

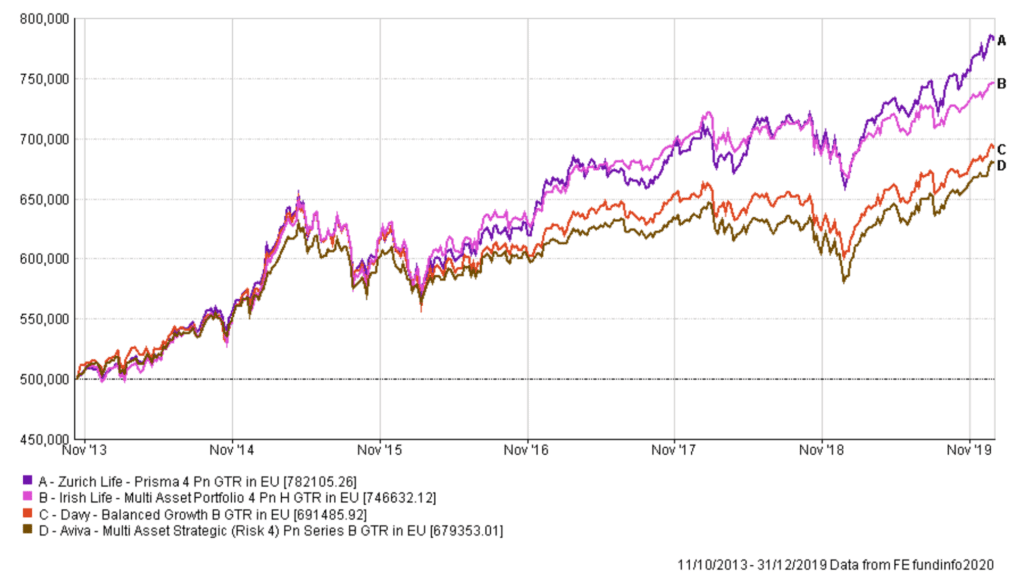

We took the Davy GPS Balanced Growth Fund and had a straight shoot-out with some of it’s closest competitors of a similar nature. By similar here we mean we selected only funds that have a very similar underlying asset proportion and overall volatility ratings of 5.9 to 7.1.

We illustrated a €500k investment in each of the following funds over the period of Nov 2013 to December 2019: Aviva Multi-Asset Strategy 4 / Irish Life MAPs 4 / Zurich Prisma 4 / Davy GPS Balanced Growth Fund

It was all fairly neck & neck until end of 2015, beginning of 2016, before the gap between the lead pack of Zurich and Irish Life, and the chasing group of Davy and Aviva appeared, and it has got only wider since. Davy Balanced Fund, based on this analysis trails the top performer from this small sample, by €90k. That is a lot of growth that most investors would much rather be in their pocket if they could.

What About A Simple & Pure UCITS Approach:

We never claim to be be at the cutting-edge of investment analysis and predictions, we don’t need to do that. We rely on evidence and an elegantly diversified approach for our own, and client investments. We always advocate simplicity over complexity, transparency over opacity and cost effectiveness over expense when it comes to investing. There are endless reams of research and evidence to suggest that this un-sexy and un-flashy approach works for the long term patient investor (as opposed to picking what works for the provider!).

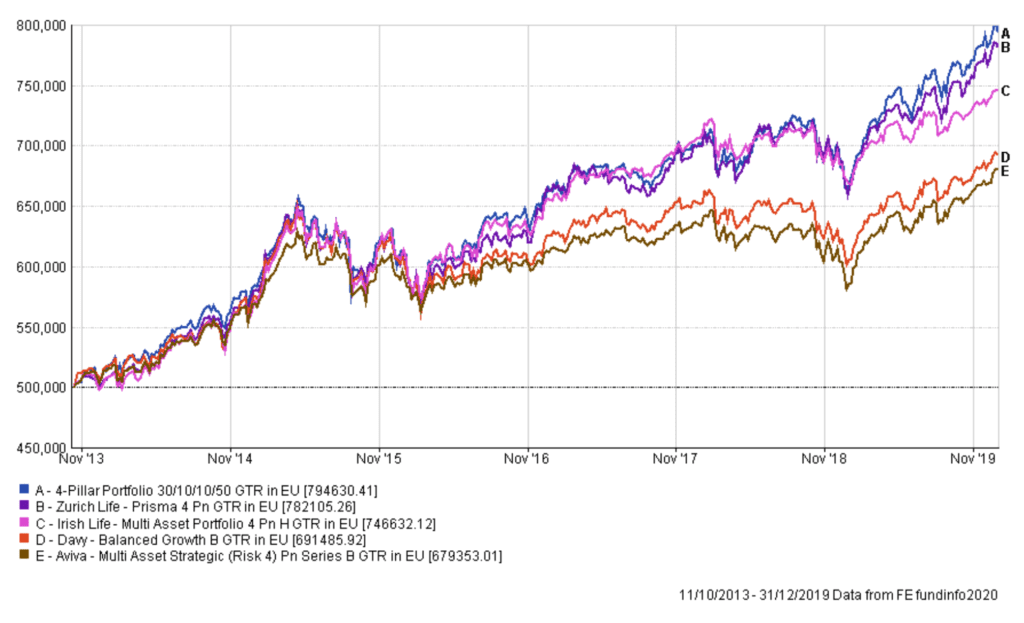

So, we added another horse to the analysis. We slotted-in a very simple and in our view, elegant portfolio of just 4 index funds which really effectively capture the returns of Global Equity and Global Bonds. There are 3 funds of blended Global Equity, and 1 blended Global Bond Fund. This portfolio we included has 50% Equity and 50% ‘Defensive’ assets – with a volatility rating of ‘7’. This is what I would call ‘conservative’, and not something I would recommend – but in the interests of making an ‘apples with apples’ comparison it was what we had to do!

No prizes for guessing which horse won this race…………..and that is before we include the fee differential. Simplicity wins the race.

If you are are looking at the GPS funds and you decide, or are convinced that you are an ‘Adventurous’ investor, you will possibly end up in the Davy GPS Long Term Growth Fund, thinking you are in the right place. Truth is, for an ‘adventurous’ fund it has a high % of defensive assets. Again, one can only assume that that is how they were intentionally designed.

Had you invested in something like the ‘Long Term Growth Fund’ thinking you were getting full exposure to the market’s constant upward curve – you are mistaken. You still have a reasonable amount of your portfolio in defensive assets, as of December 2019 anyway.

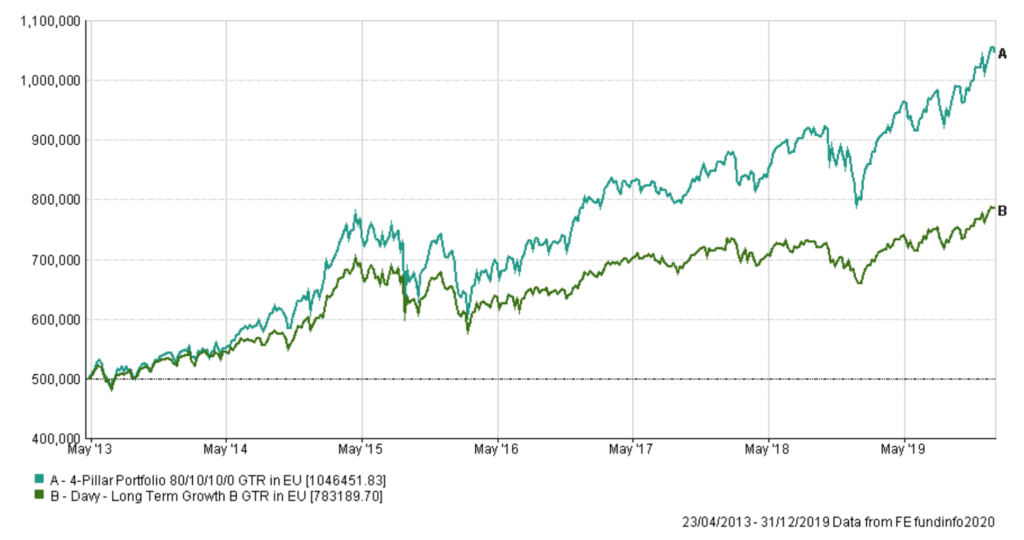

Below is a 2013 to December 2019 head-to-head comparison. Here we compare the performance of the Davy Funds GPS High Growth Fund (made up of 30-odd underlying funds and variety of equity, alternatives, bonds etc.) versus a simple and elegant portfolio of 100% Global Equity. The latter consists of just 3 effective and diversified Global Equity Index Funds from the top funds in the world. It has a volatility rating of ’12’ which is in line with a ‘high volatility’ funds. But when we reflect and realise that volatility is really just an efficient market’s way of rewarding the uncertainty, we can start to think a little differently about it.

You will see that the simple approach is more volatile, the peaks are higher and the troughs are deeper. But that is what long term equity investing is meant to look like right!?

Had you invested in the Davy Fund in 2013 thinking you were investing in something which was going to give you the full returns of equity markets. – would you be pleased with how your fund has performed versus a pure equity approach.

When you see that you are now more than €250k off the pace, you might not be delighted. Part of the reason for this difference in the two approaches is that you were actually invested in a blend of Equity, Bonds, & complex Alternatives.

On the flip-side, the lower volatility Davy Fund will typically fall less when markets hit their periods of temporary declines. In order to illustrate this we illustrated how a €500k investment made in each fund on 1st Jan 2020 has faired. Unless you have removed every source of investment media from your immediate environment (in which case I salute you!), you will know that Equity funds have had some temporary declines in the past couple of weeks. As expected, the Davy Fund has fallen less in these weeks than the pure equity fund, down 4% and down 7.3% in that period. Given Davy Long Term Growth Funds holds more defensive assets it generally wont fall, nor rise as much as equity funds.

Davy GPS Funds Fees:

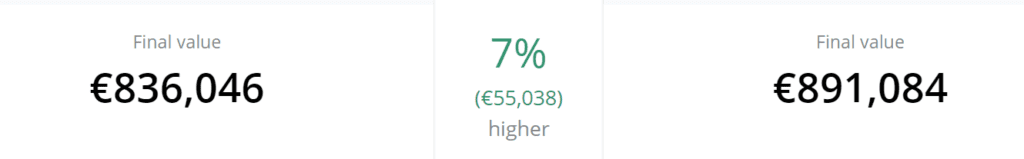

The fees on these funds is quite on a par with it’s competitors, slightly lower than some and a lot lower than others! Investors should realise that they can secure access to the pure index funds for a total actual annual cost of 1%, which will include comprehensive financial planning and guidance as part of the deal!? But sure a 0.65% difference is not enough to make any difference surely? Let’s see how that lower fee could benefit you shall we!?

Taking that same investment of €500,000, either through a pension or thru a personal investment for 10 years, and achieving an illustrative 7% per year. Invest it in 2 different structures, you pay 1.65% on one 1% on the other. The difference in your final gross pot value, purely due to that differential of 0.65% (which sounds like nothing!) would actually be:

Yes, €55,000 more in your pot when you paid 0.65% less per year over that 10 year period alone. Throw in a annual percentage or two of fund performance and you are into ‘price of a new house’ territory of €200k plus!

Oh, the fund Key Investor Document (KID) also outlines that an investor in the Davy Funds will also pay a maximum ‘entry charge’ of 5% of the amount they invest, and a maximum ‘exit charge’ when they take funds out, of 3%. If you were investing €500,000 and paying the max 5% up-front commission or fee that would equate to €25,000. Exit fee of 3% on same amount would be €15,000. Not insignificant if that was what you ended up paying, on top of the annual fees.

Conclusion

The numbers speak for themselves. In line with both Equity and Bond markets these funds have increased in value over the past 6/7 years. The question that you may ask is if they give you sufficient effective access to the constant upward curve of Equities that you are looking for, or not.

Over history, in order to achieve ‘better’ returns you have not had to find the smartest fund manager, or the one with the biggest marketing budget, or indeed the one that charges the most. In most instances all you had to do was invest in funds which give you pure access to the market returns, while avoiding the complex over-engineered stuff.

And the last piece of the jigsaw is the simplest-sounding but in practical terms is the hardest of all, the human behaviour aspect! To not react when markets do. To stay invested when the mania strikes and everyone and their granny is running to cash-in their chips. For example, if you had pulled your cash out of your investments when they were 20% down in December 2018 the underlying funds didn’t matter a single iota! Really, it will matter not a jot whether you are invested in a simple index portfolio, a Davy, Irish Life, Aviva, Zurich or any other product on the planet if you are likely to have a panicked reaction to temporary declines. If you can’t be patient you can’t be a long-term equity investor – it really is as simple as that.

That’s where your empathetic and professional financial planner can earn their fee multiple times over, by helping you avoid a mistake when markets are either severly high or severely low. You might think that you are too smart to need that help, but believe me, we are all human. I remain convinced that the only way to FULLY capture the return of equities is to participate FULLY in their temporary declines. Leave the ‘timing’ to the clocks!

Paddy.

Warning!

The information in this article was fully accurate at the time of publishing. Lots will have changed since! The value of your investments can rise and fall – you could back less than you invest in any investments – your capital is at risk in such investments – you’ve been warned!

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.